HEADLINES

Thu, Dec 25, 2025

Nigerian Banks raise N1.7trn through e-Offering in Recapitalisation Exercise

By ruth MALAGU

Director- General of SEC, Emomotimi Agama (middle) and Executive Commissioners of the Commission

Director- General of SEC, Emomotimi Agama (middle) and Executive Commissioners of the Commission

The Securities and Exchange Commission (SEC) says N1.682trn has been raised by Banks through e-Offering in the Recapitalisation Exercise.

Emomotimi Agama, the Director- General of SEC, said this in a Statement on Wednesday in Lagos.

The Central Bank of Nigeria (CBN) in March released new Guidelines on the Minimum Capital Requirement for Banks operating in Nigeria.

This ranges from N50bn to N500bn, depending on the type of Licence held by the Bank and in total, approximately N4.14trn is expected to be raised by March 31, 2026, which is the deadline.

CBN said that the Bank Recapitalisation Exercise was aimed at strengthening the Financial Institutions and achieving President Bola Tinubu�s One Trillion Dollar Economic Target.

The Director-General stated that the Launch of the e-Offering Platform had been instrumental to the success of the Exercise so far.

He explained that the Amount was raised in 12 Applications by Nine Banks, while some Applications were still open pending. According to him, Technology is an Enabler in the Capital Market and a Prime Tool for Growth.

Agama added that the Commission would continue to employ Technology in different angles to aid its Work and ensure a deeper Capital Market.

�What you have seen so far is the use of Technology to drive the Market with more Investors coming into the Market.

�We just launched the e-Offering Platform that ensured the Offering Processes for Banks, and over N1.7trn was raised. That tells you what Technology can do.

�We are also exploring Technology for other Activities, such as, Monitoring and Surveillance and other Processes that will bring about a cohesion of all the Policies that SEC has applied to make the Market grow bigger,� he said.

He noted that the Commission had implemented various Initiatives to reduce time to Market, including streamlined Registration Processes, Introduction of an Electronic Filing System and enhanced Regulatory Frameworks, among others.

The efforts, Agama said, were aimed at improving the efficiency and attractiveness of the Nigerian Capital Market, while promoting Economic Growth and Development.

He said: �A shorter time to Market can benefit Capital Market Development in several ways, such as increased Liquidity; faster listing allows Companies to access Capital more quickly and increase Liquidity in the Market.

According to him, the One Trillion Dollar Economy is feasible, especially with the drive and commitment of the President in ensuring that other Sectors of the Economy are in full swing.

The SEC Boss further said that the Nation needs to diversify the Economy beyond Oil Exports, by investing in Infrastructure, Human Capital and Innovation, to enhance the Business Environment.

Agama added that the Country must also reduce Regulatory hurdles, as well as promote Financial Inclusion and Access to Credit for SMEs and Individuals.

Credit NAN: Texts excluding Headline

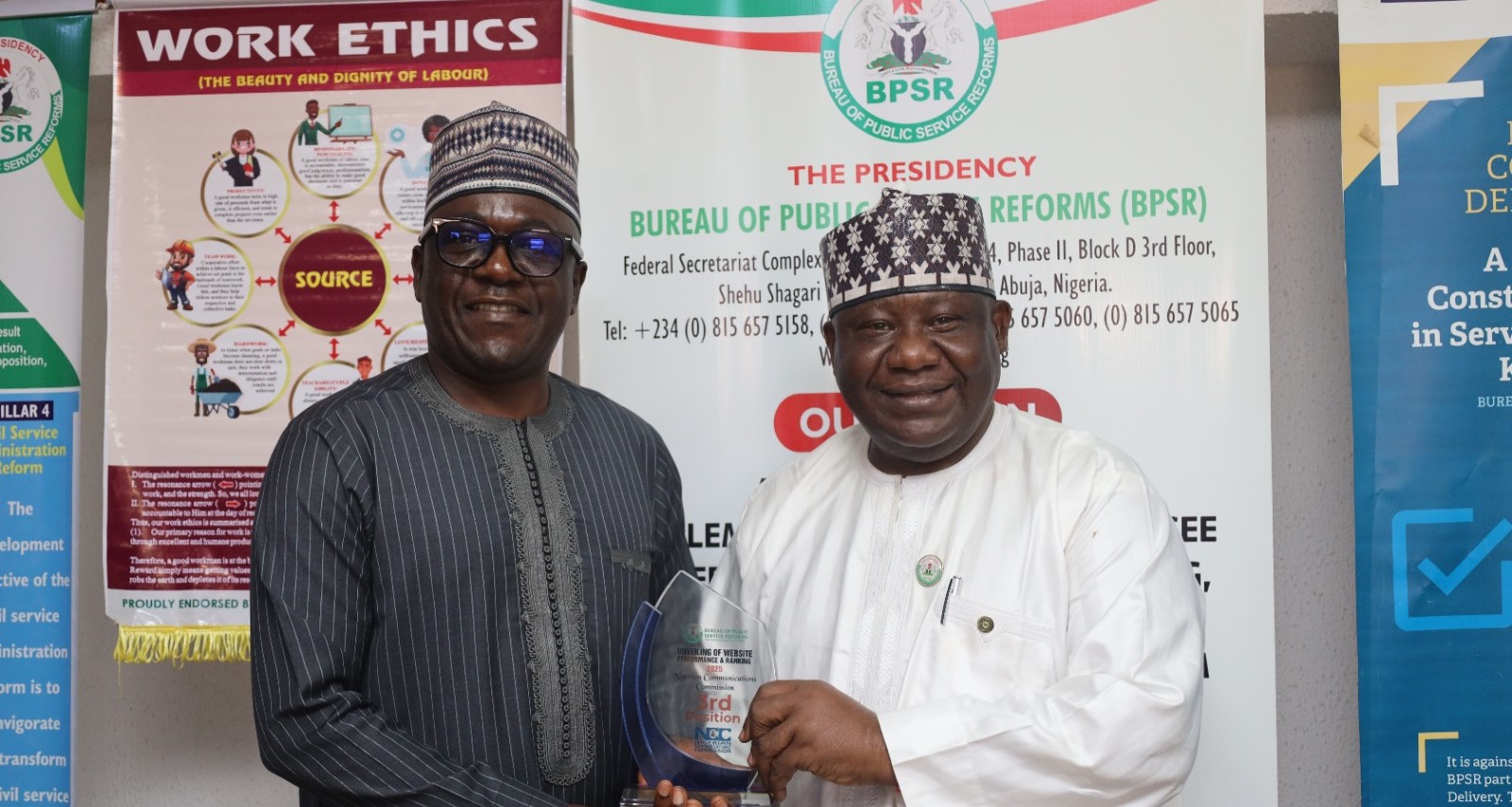

News in Pictures

Copyright 2025, Thenewsroom.ng

Comments

Be the first to comment on this post

Leave a Reply