SEC 'blesses' Mutual Fund with N18.2bn

The Securities and Exchange Commission (SEC), supported growth of the Fund Management industry in 2023 with approvals for new Mutual Funds with N18.20bn.

According to SEC, the support also includes Discretionary/Non-Discretionary Investment Products with N17.60bn.

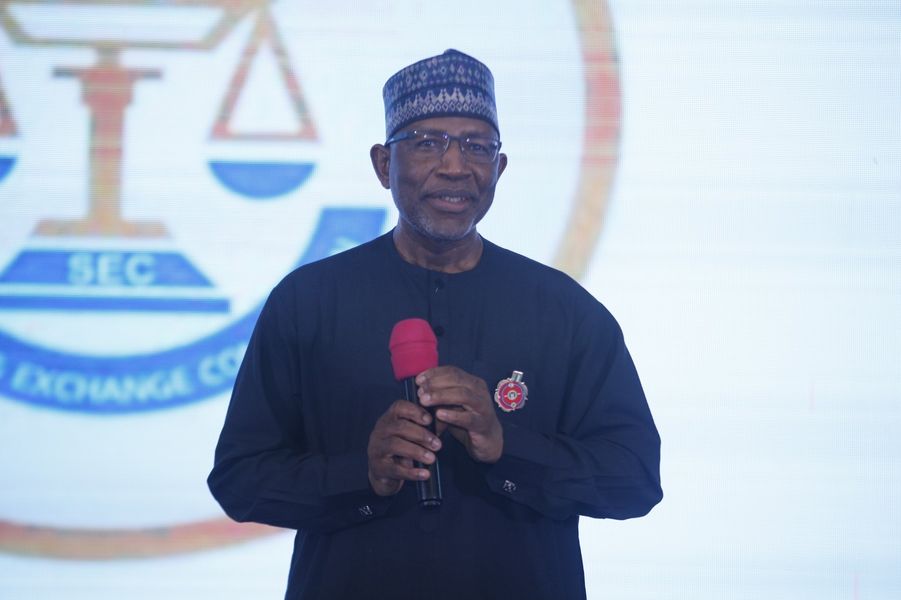

The Director-General of the Commission, Lamido Yuguda, said this while briefing Journalists at the post Capital Market Committee (CMC) Meeting in Abuja on Friday.

The Funds management is the overseeing and handling of a Financial Institution�s Cash Flow.

The Fund Manager ensures that the Maturity Schedules of the Deposits coincide with the demand for Loans, the Manager looks at both the Liabilities and the Assets that influence the Bank�s ability to issue Credit.

Yuguda said that SEC approved five Infrastructure Fund Shelf Programmes totalling N1.5trn as a major step forward.

He said the Commission Amended Rules governing Digital Assets and established a Digital Exchanges (DEX) Division dedicated to the supervision of all duly licenced Digital Asset Platforms.

�On Market Supervision, the Commission has intensified its supervisory efforts, focusing on Fund Managers and conducting Inspections to address vulnerabilities and enhance stability.

�This has resulted in the implementation of a number of corrective measures designed to strengthen the overall health and stability of the Fund Management Industry.

�Progress was reported on implementing Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) Regulations and addressing deficiencies identified in the Financial Action Task Force (FATF) Mutual Evaluation Report.

�The Commission has been working with the Nation�s Regulatory and Law Enforcement Agencies to ensure that Nigeria is taken off the FATF grey list,� he said.

The Director-General said that the Commission would inaugurate Securities Issuers Forum to discuss attracting more Issuances to the Market and a Roundtable on leveraging Crowdfunding to support MSMEs in May.

Credit NAN: Texts excluding Headline

Comments

Be the first to comment on this post

Leave a Reply